Creating strategy

There are two ways to start creating a strategy:

select Strategies in the Modes drop-down list of the Portfolio Management section;

select a section in the Strategy builder in the main menu.

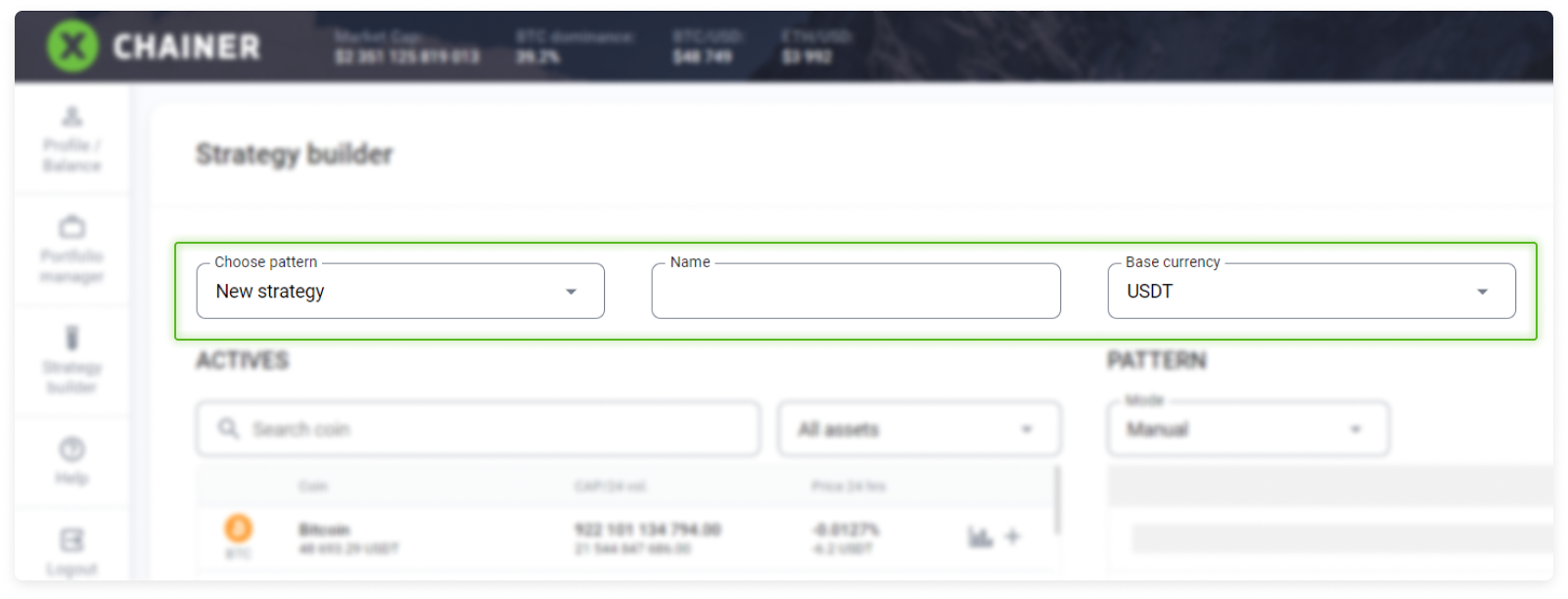

In the basic settings, select New strategy. In the Name field, enter a name for the strategy. From the Base currency drop-down list, select USDT, USDC, BUSD or BTC (beginners will find it easier to use USDT, USDC, BUSD).

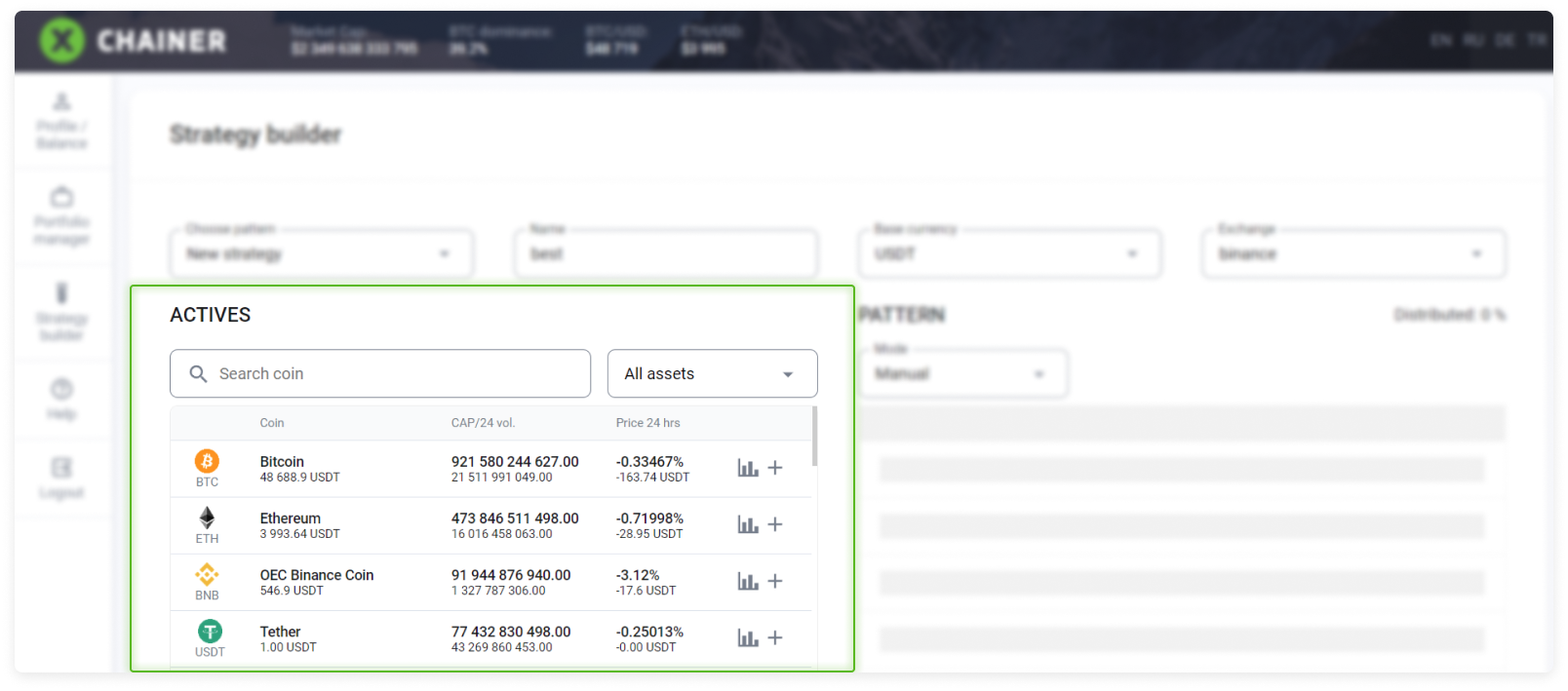

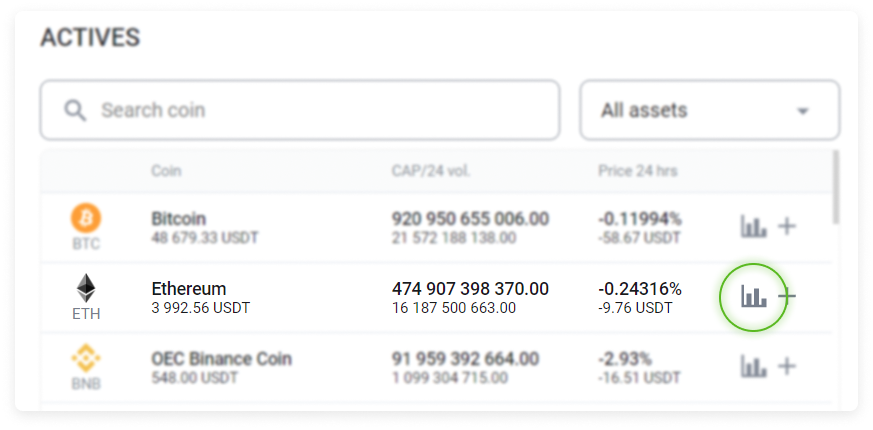

You can assemble a portfolio structure by selecting the desired currencies in the ACTIVES table.

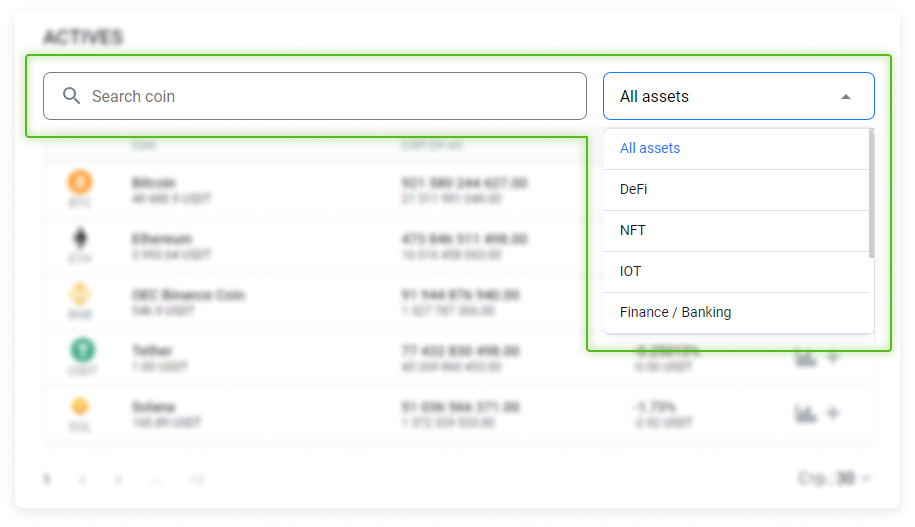

In order to assemble a portfolio as easily as possible, use the Search coin field or the All assets. drop-down list.

All assets. Here, investment products are classified into 7 groups according to niche segmentation:

DeFi – Assets related to a decentralized finance market.

NFT – Tokens used for NFT technology projects.

IOT – Internet of Things technology.

Finance/Banking – Financial services and banking sector.

Binance – Project tokens based on the Binance Smart Chain (BSC) ecosystem

Polkadot – Projects based on Polkadot technology.

Exchange-Based – Exchange platform tokens.

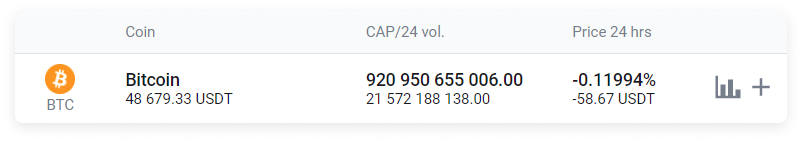

Each asset line contains:

Ticker;

Name and current market price;

Total market capitalization and daily trading volume;

Change in the price during the last 24 hours expressed as a percentage and forex equivalent;

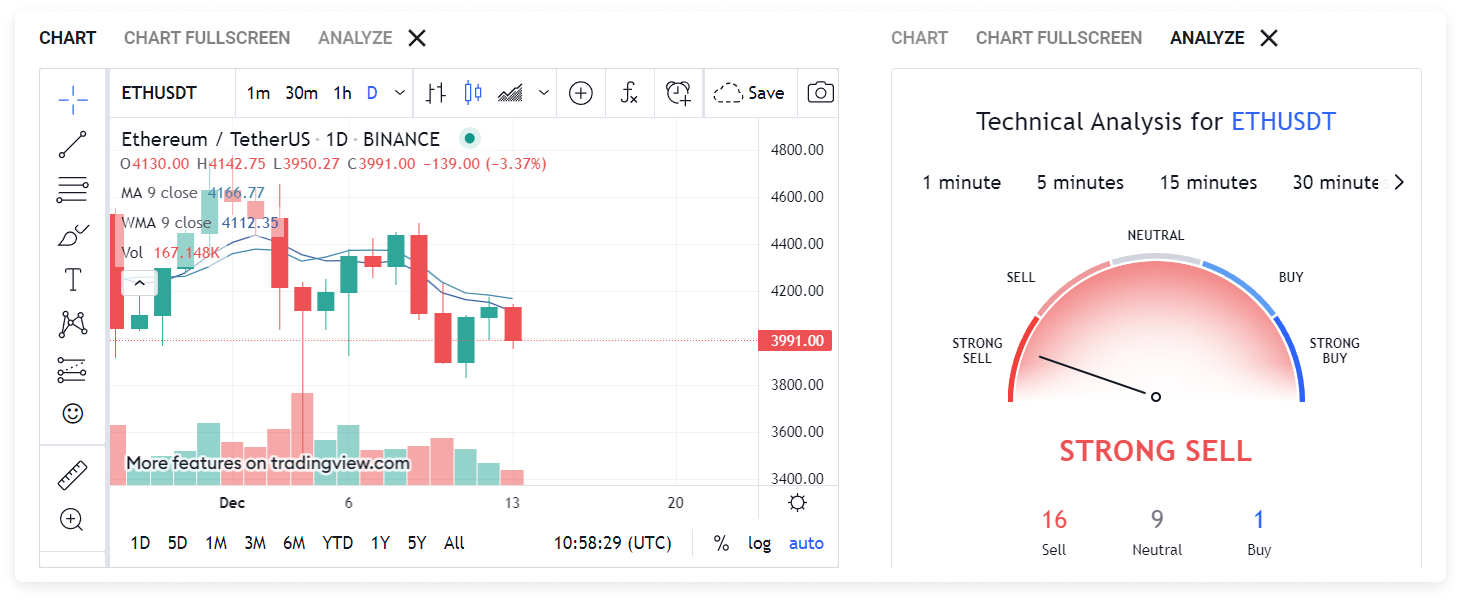

Chart symbol – This displays the analytics for this asset from Tradingview;

Plus symbol – This adds an asset to the Structure table when creating a strategy portfolio.

By selecting the Chart icon, you can see the analytics from Tradingview for the selected asset.

Strategy portfolio structure.

Let's consider an example of how to create a new strategy.

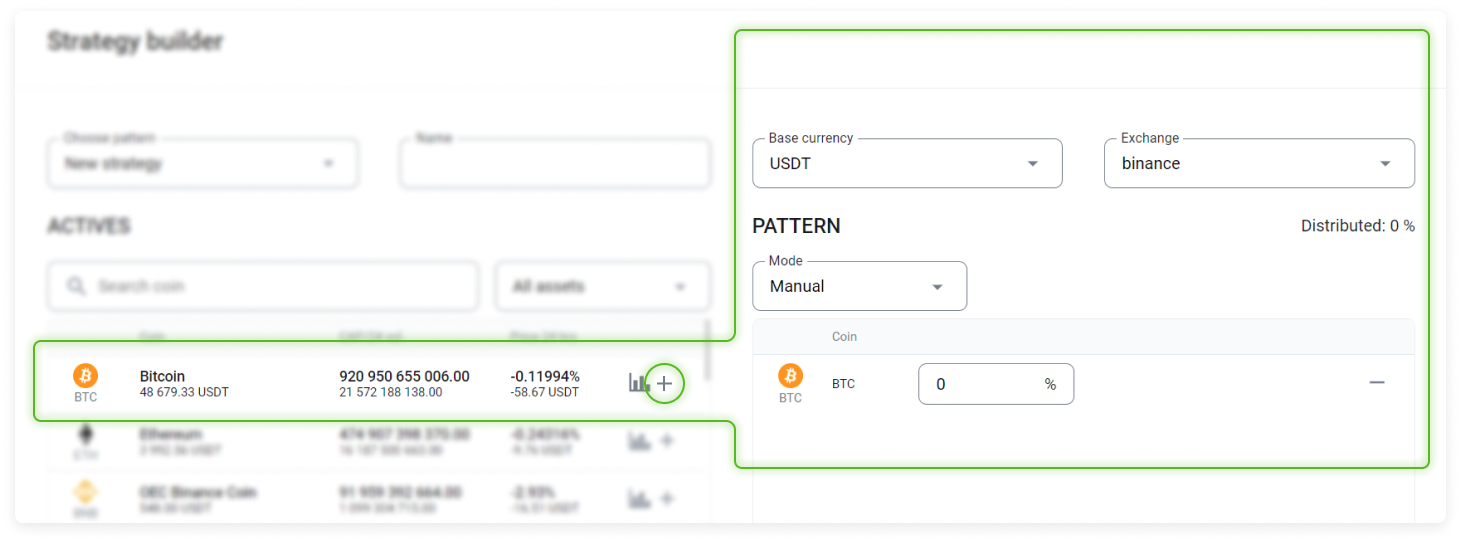

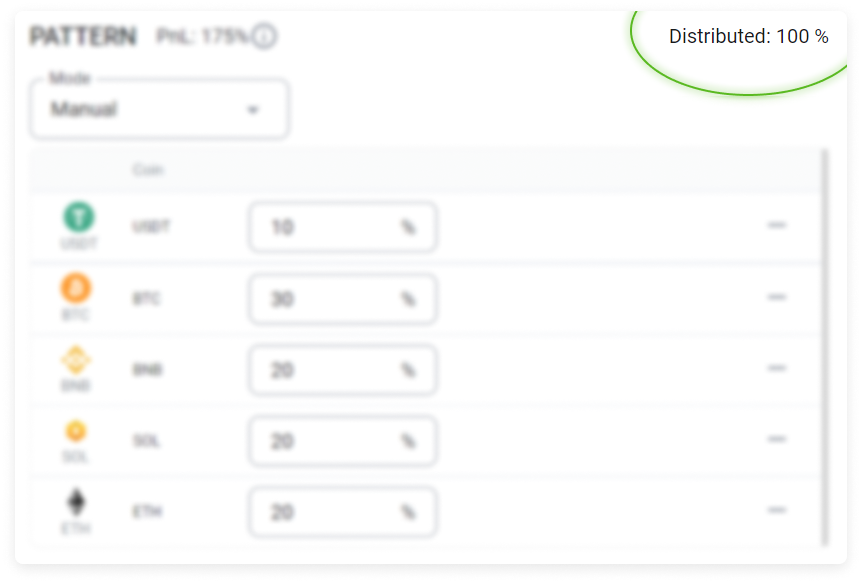

Use the Plus icon to select an asset. It will be added to the Pattern table.

Let's take 5 assets as an example and see how we can assemble a portfolio from them. You can remove any mistakenly added assets using the Minus (-) button.

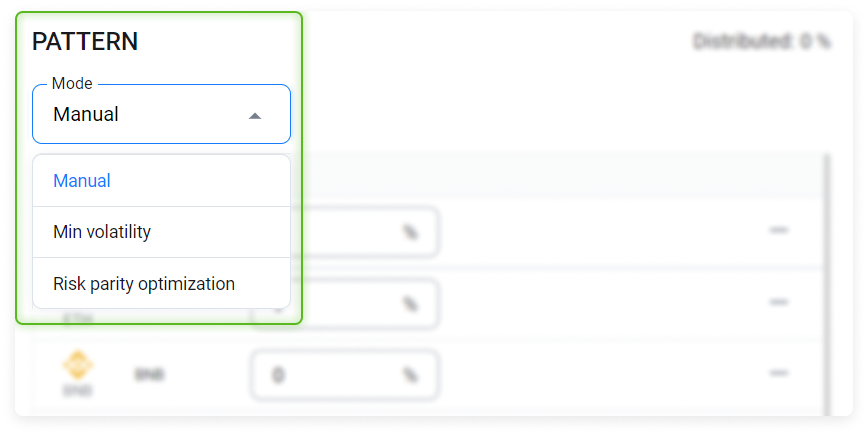

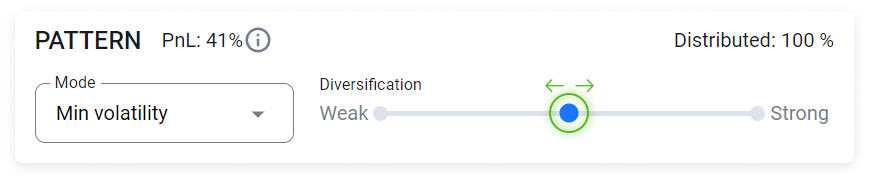

After you have assembled the portfolio, you need to set up the asset ratios within it. You can either do this manually or use one of the following two automatic settings:

Min volatility – This setting determines the asset weights in such a way as to minimize portfolio volatility based on historical data;

Risk parity optimization – This optimizes portfolio risk in accordance with a given diversification based on historical data.

Once you have selected one of the automatic modes, you can manually confugure the diversification. To do this, move the indicator along the horizontal line by dragging with the mouse.

When manually allocating assets, the weights must add up to 100%. Otherwise, the system will not allow you to save this strategy. The sum of the weights is shown above the Pattern table on the right.

Automatic rebalancing.

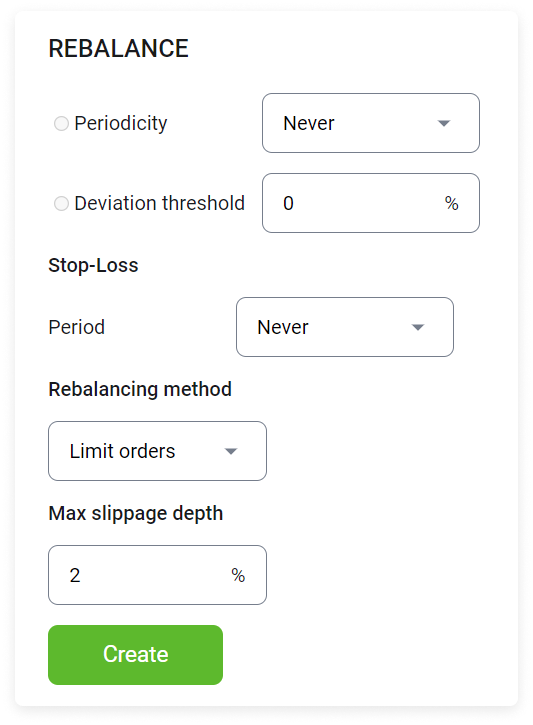

After you have decided on the diversification of the portfolio structure, you can proceed to rebalancing.

Rebalancing returns the strategy structure to the original distribution of asset weights, restoring the degree of risk to its original level.

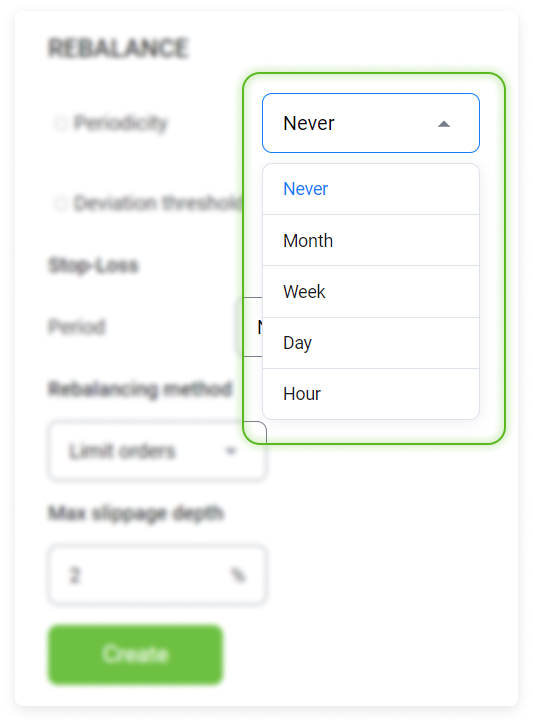

In the Periodicity drop-down list, you can leave the default setting Never checked (to not apply an interval) or select one of the following periods of time:

Month

Week

Day

Hour

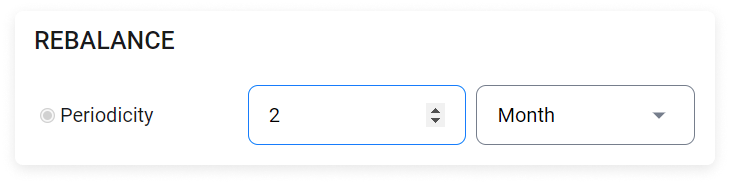

Set the rebalancing frequency. In this example, the rebalancing will take place every two months.

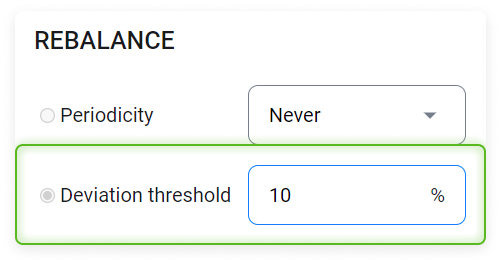

The Deviation threshold setting is an alternative to the Periodicity setting.

The deviation threshold is calculated for a single asset. It triggers a rebalancing as soon as the deviation from the configured share is +/- 10% of 100% of the asset's appraised value.

For example:

The portfolio structure contains 60% BTC.

Given a total assessed portfolio value of $3,000 in the base currency, the value of the BTC share will be equal to $1,800;

The amount of $1,800 is equal to 100%, that is, the rebalancing will be performed when it reaches minus 10% (or $1,620) or plus 10% ($1,980);

In this case, the rebalancing will affect all assets in the portfolio. A corresponding entry will appear in the Rebalancing history.

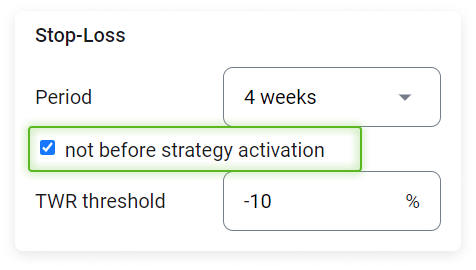

The Stop Loss is applied to the total value of the entire portfolio. When it is executed, it converts all assets to the base currency (USDT, USDC, BUSD or BTC, depending on the strategy settings).

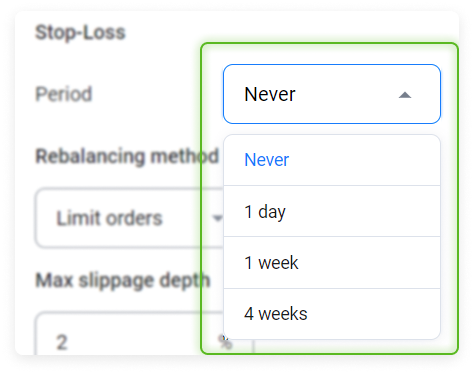

For example, if you select -10% for 4 weeks, then when this period elapses with a TWR indicator of minus 10%, all assets in the portfolio will be sold for the base currency. In the Period drop-down list, you can leave the default setting Never checked (to not apply an interval) or select one of the following periods of time:

One day;

One week ;

Four weeks.

Enabling the “not before strategy activation” option will allow you to account for the profitability that will be generated during the strategy period. Any previously obtained return will not be taken into account.

For example, at the time the strategy was activated, the account had already recorded a TWR of minus 10% per day. The investor needs to take into account the profitability, which is determined only for the period of the strategy. In this case, this option must be enabled.

Set the TWR threshold.

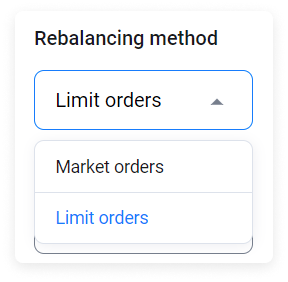

Choose which type of orders to be used for rebalancing:

Market orders. Rebalancing will be performed using market orders. This is a convenient way of quickly selling an asset;

Limit orders Rebalancing will be performed using limit orders. This is a convenient option to rebalance at the most favorable prices.

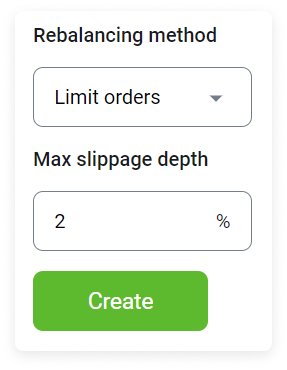

When choosing the Limit orders rebalancing method, you can set the maximum order slippage (by how much the order execution may differ from the one declared in the order book).

For a large volume asset, setting a larger coefficient will allow you to execute the order as quickly as possible.

Once you have entered all of the required information on the page, click the Create button.

Applying the strategy

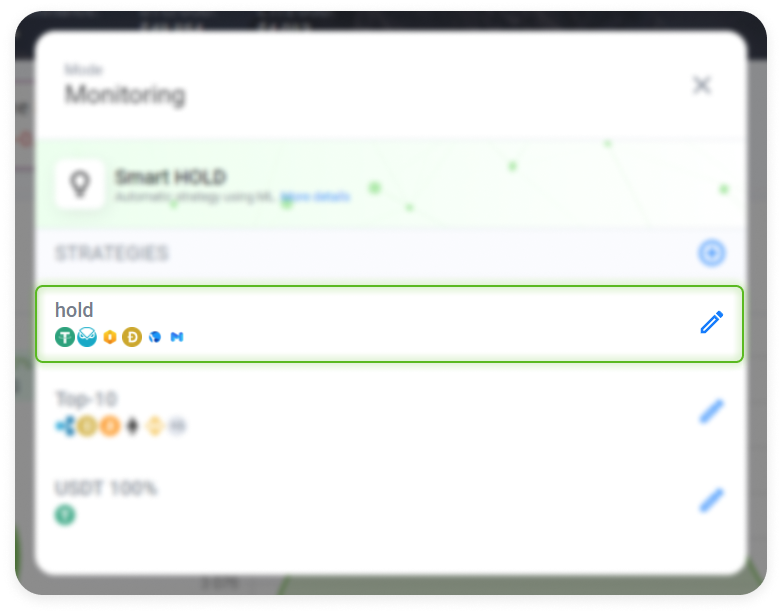

Method. 1. To apply a strategy to an account, in the Portfolio Management section, select the strategy you want to execute from the Mode drop-down list.

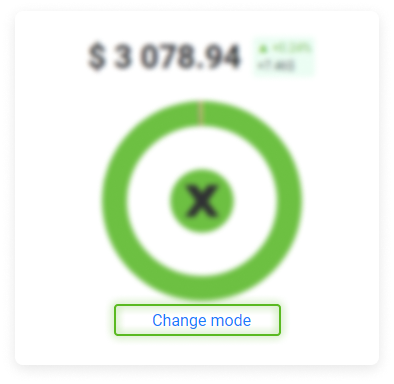

Method 2. If Monitoring mode is active on the account: Under the dynamic structure graph for the portfolio, select Change mode.

In the new window that opens, select a strategy.

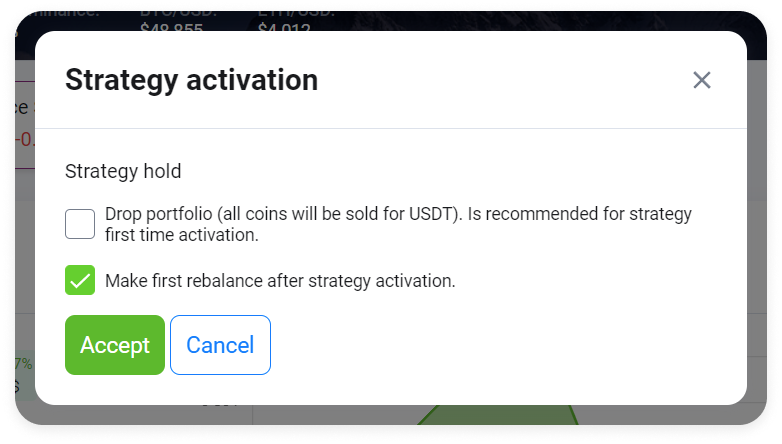

The new Strategy activation window contains two options:

Drop portfolio (all coins will be sold for USDT). It is recommended to leave this box checked if you are applying the strategy to your account for the first time to ensure the accurate calculation of statistics and return.

Make first rebalance after strategy activation. It is recommended to leave this box checked. When you click Accept, the first rebalancing will be performed, which will make the portfolio conform to the structure specified in the strategy.

After determining the distribution of the options, click Accept. The strategy will be activated.

One strategy can be applied to multiple accounts at the same time.

Please note: If changes are made to the strategy after it is already executed, these changes will be applied to all accounts that are currently following the strategy.

Changing an active strategy.

While the strategy is active, you can edit the following:

Name;

Base currency;

Pattern (remove or add new assets by rebalancing);

Automatic rebalancing settings;

You can also connect modifiers to each individual asset (Stop-Loss or Trailing Take Profit).

For an active strategy, you can generate a copy of it with added modifiers and apply it to an account while leaving the current strategy unchanged.