Modifiers in XChainer are the settings for determining the losses and profits of individual portfolio assets. They operate on the basis of a profitability indicator, and when executed, temporarily modify your strategy.

The types of modifiers are:

Stop-Loss - It converts assets to your base currency when the yield of the asset to which it is applied falls below a set level.

Trailing Take Profit - It achieves more profit for you when the price increases. This tool is especially useful when there is strong unidirectional price movement.

When is it recommended to use modifiers?

When you create a portfolio with the least reliable assets that offer high potential profit, but also high risk. These include, for example, hard-to-sell or young assets that have recently appeared on the exchange and that are not highly capitalized.

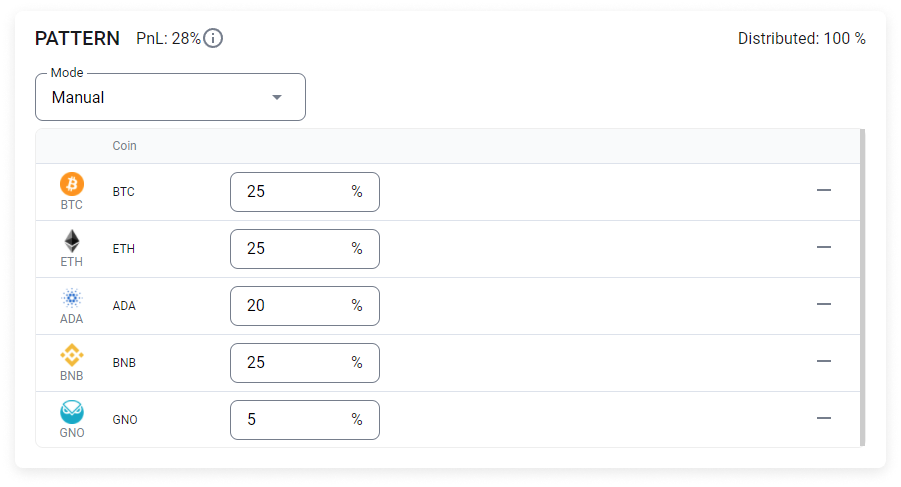

Consider, for example, a portfolio structured around Bitcoin, Ethereum, Cardano, BNB, and Gnosis - GNO.

We added GNO to the portfolio at a ratio of 5%, because it is the most risky asset compared to the rest of our portfolio. In turn, we consider the remaining assets in the portfolio to be the most liquid and longest term ones.

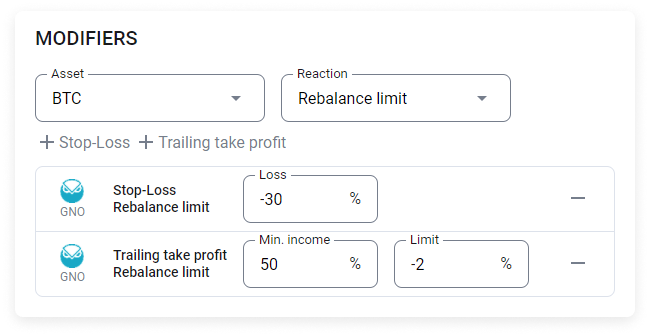

In this case, we are planning for long-term portfolio investment. In the event that the GNO price falls, we will lose no more than 30% and receive revenue plus 50%.

Choose the appropriate modifier settings.

Modifiers may be configured when creating a new strategy or applied to a previously created and already active strategy.

Please note: The modifier works with asset profit may only be applied to them.

Two modifiers can be applied at the same time to a single asset.

A modifier can be changed or removed at any time before it is executed.

When the modifier was triggered, you were presented with 3 different options for what to do next.

1. Select Restore. A rebalancing will be performed whereby the sold asset will be repurchased and the previously set modifier will be maintained.

Please note: When the percentage coefficient is set, it will be based on the newly calculated return/price at which the asset was re-acquired and its ratio in the portfolio.

2. Change the portfolio structure by editing the strategy. After the changes to the strategy have been saved, rebalancing will be performed.

3. Do not take any action until the market situation changes.

Interaction of modifiers.

If two modifiers (Stop-Loss and Trailing Take Profit) have been set for a single asset, then when the TTP set value for minimum return has been reached, the Stop-Loss modifier is deactivated and it will no longer be visible in the Coins table.