The Trailing Take Profit modifier is intended to help you achieve more profit when the price increases. This tool is especially useful when there is strong unidirectional price movement in your favor.

The Trailing Take Profit modifier can be configured in Portfolio Management (if strategy mode is active in the account) or in the Strategy Editor.

Lifecycle of the "Trailing Take Profit" modifier

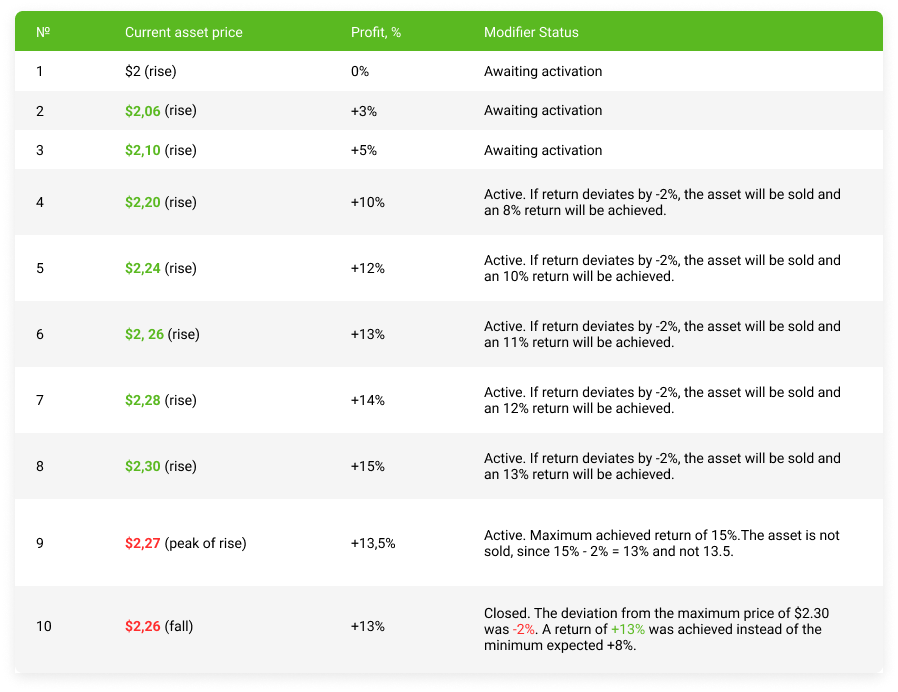

1. Let's consider the lifecycle of the modifier by considering an example table indicating the change in price, profit, and the status of the modifier.

Suppose we purchased some ADA (price $2) cryptocurrency. In the settings for the TTP modifier, set:

A minimum profit of 10%. This is the minimum profit level at which the modifier will be activated;

A limit of -2%. This is the limit for downward deviation from the maximum achieved profit after the Take Profit level has been reached.

The established settings mean that if the return reaches 10% and the price immediately goes down, then the minimum return that the modifier will achieve will be about 8%.

The price finally rises to $2.20 and reaches the minimum return of 10% that we set in the TTP settings. At this moment, the modifier is activated and starts to follow the price. If the value of Cardano drops by 2 percent, Trailing Take Profit will sell the asset and an 8 percent return will be locked in.

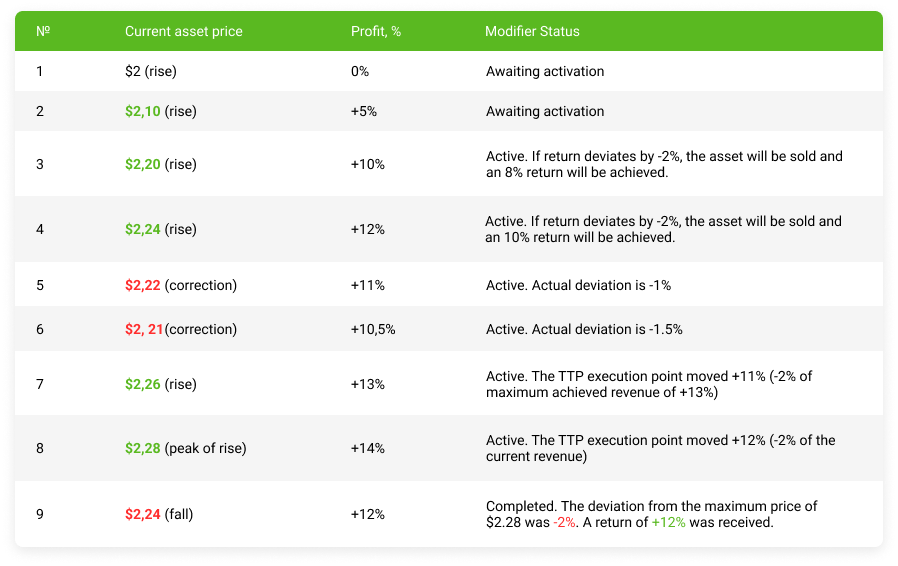

2. Let's consider another scenario where the price of Cardano goes down by 1% or 1.5% without exceeding the 2% loss limit that we set in the modifier settings:

Please note: Modifiers work with return. If TTP is launched at an asset price of $2.10, then activation will still occur when the return is achieved plus 12% ($2.24). This happens regardless of when the TTP was started.

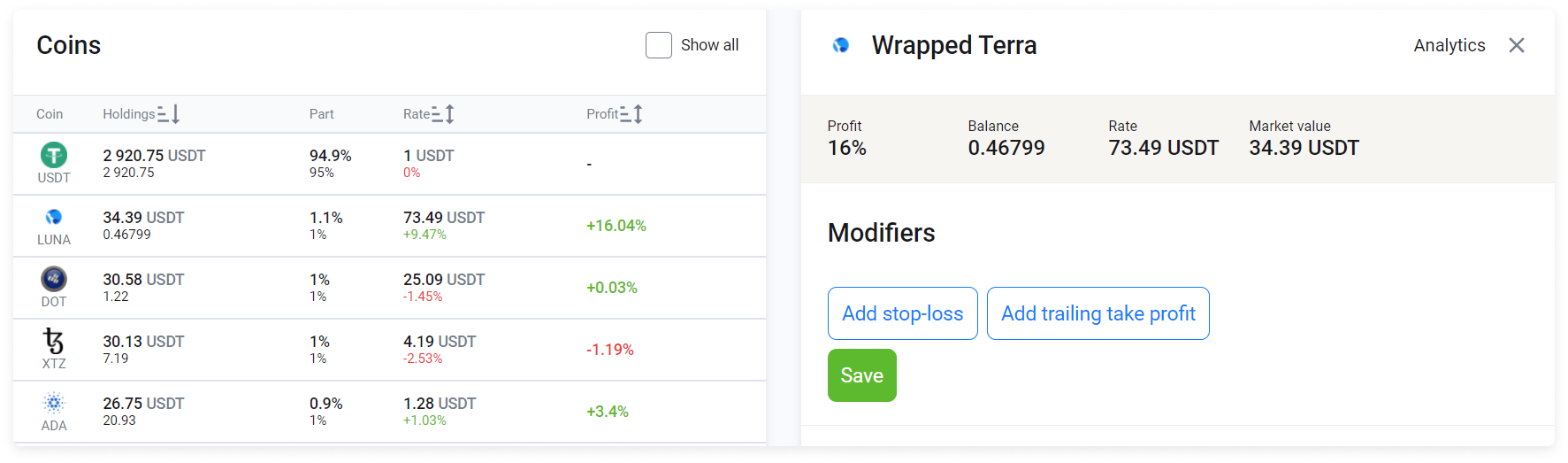

Configuration example in the Strategy Editor

Select a section in the Strategy builder in the main menu.

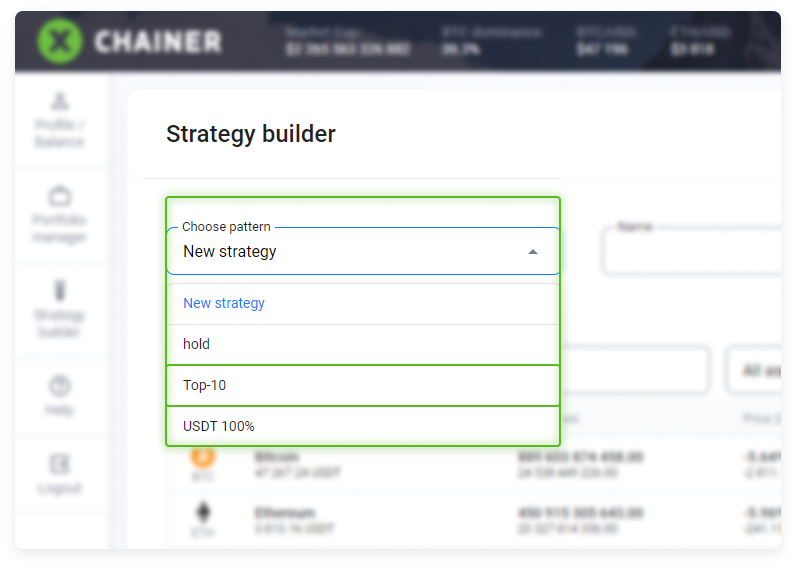

In the dropdown list, select the strategy to which you would like to apply the modifier.

The selected strategy will open. In the lower right corner you will find the Modifiers workspace.

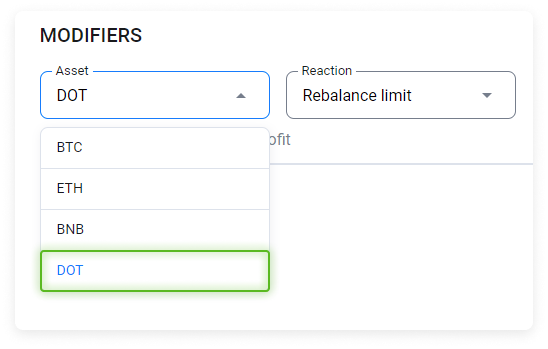

The drop-down list contains the assets that make up the portfolio of the edited strategy.

Let's take a closer look at how to work with a modifier based on the example of the DOT asset.

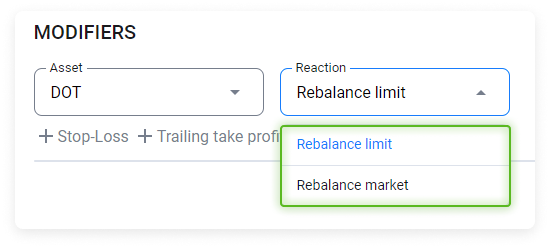

The Reactions drop-down list offers two types options::

Rebalance market Rebalancing will be performed using market orders. This is a convenient way of quickly selling an asset.

Rebalance limit Rebalancing will be performed using limit orders. This is a convenient way of selling a small amount of an asset at a better price.

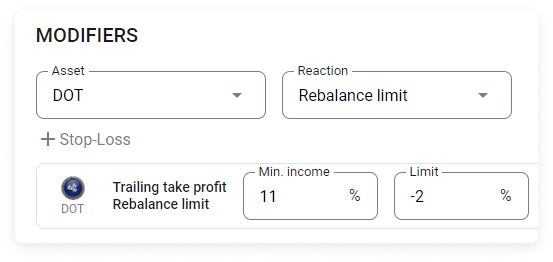

Select +Trailing Take Profit

In the Min. income window, set the minimum return at which the modifier will be activated. For example, 11%. .

In the Limit window, set the size of the return deviation from the minimum value that is attained after the TTP of 11% is activated. For example, -2%.

Choose Save.

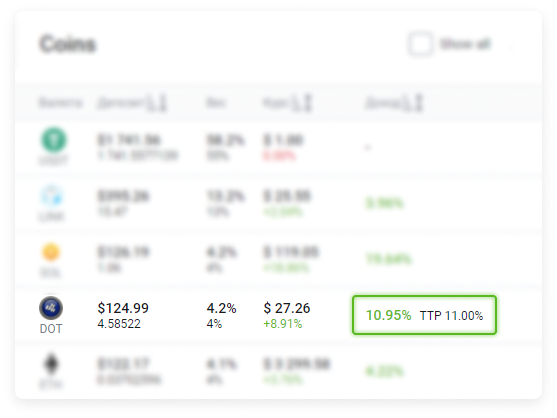

Information about the set modifier will appear in the Coins table in the asset line.

When a Profit of plus 11% is achieved followed by a drop of minus 2% from the maximum achieved price, the asset will be sold for the base currency (in this case USDT) and then rebalancing will be performed.

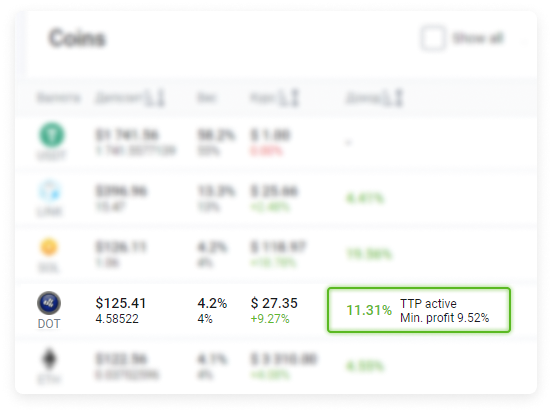

After a Profit of 11% is recorded, the record will change and the minimum return will be shown.

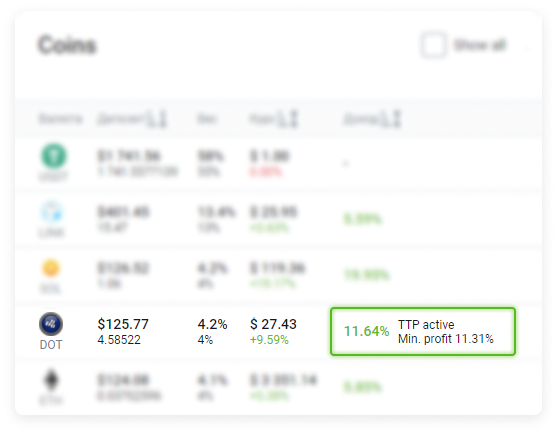

Unlike the static Stop Loss entry, information about Trailing Take Profit is dynamic and will change in response to a new upward trend in return.

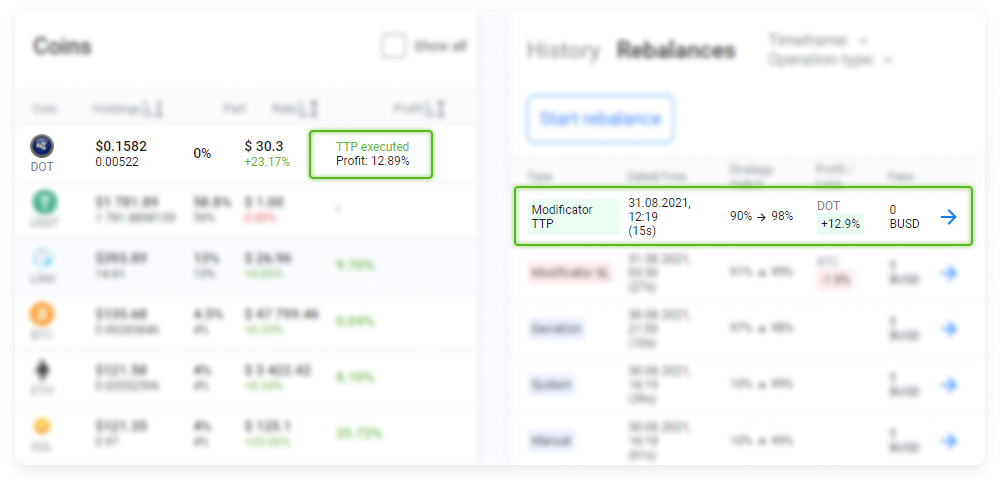

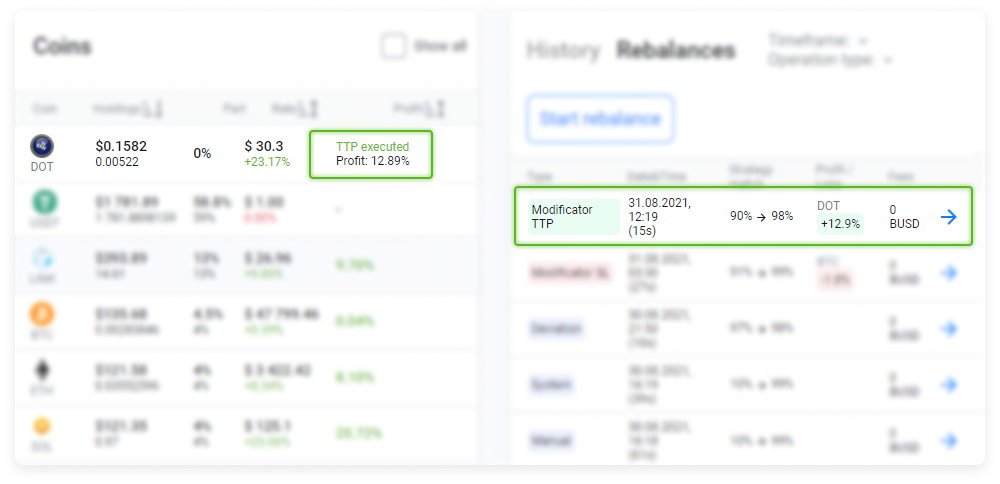

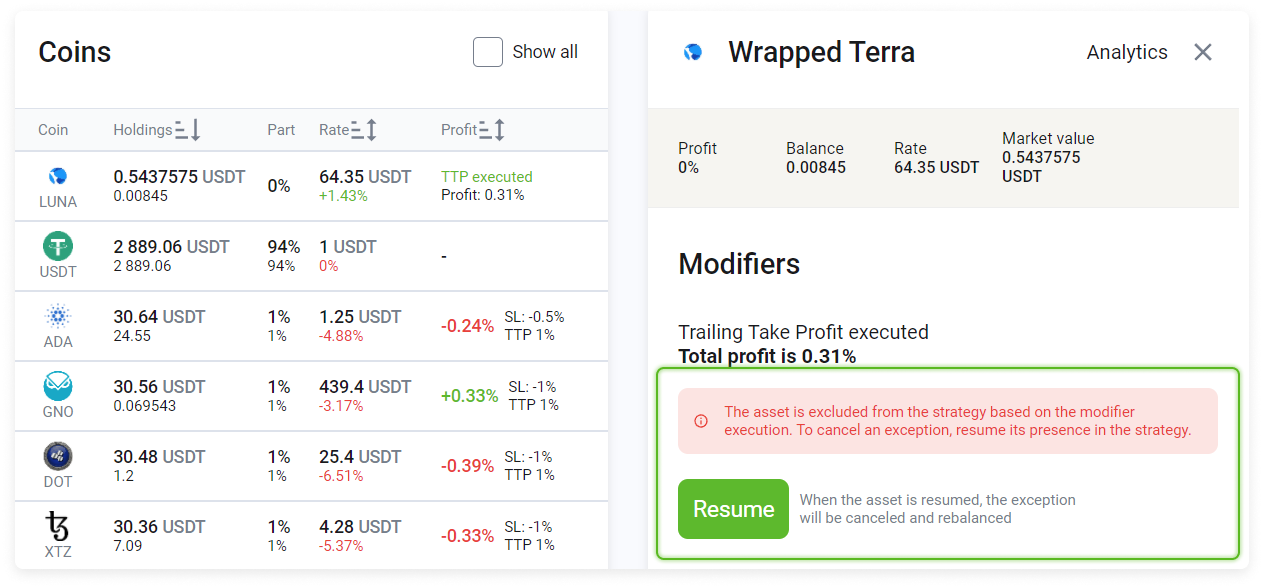

After the TTP is triggered in the Coins table in the Profit column, the execution of TTP - executed will be locked in and the locked-in return will be recorded.

An entry about this will also appear in the Rebalancing history.

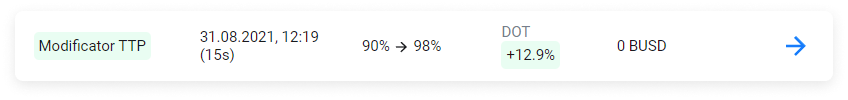

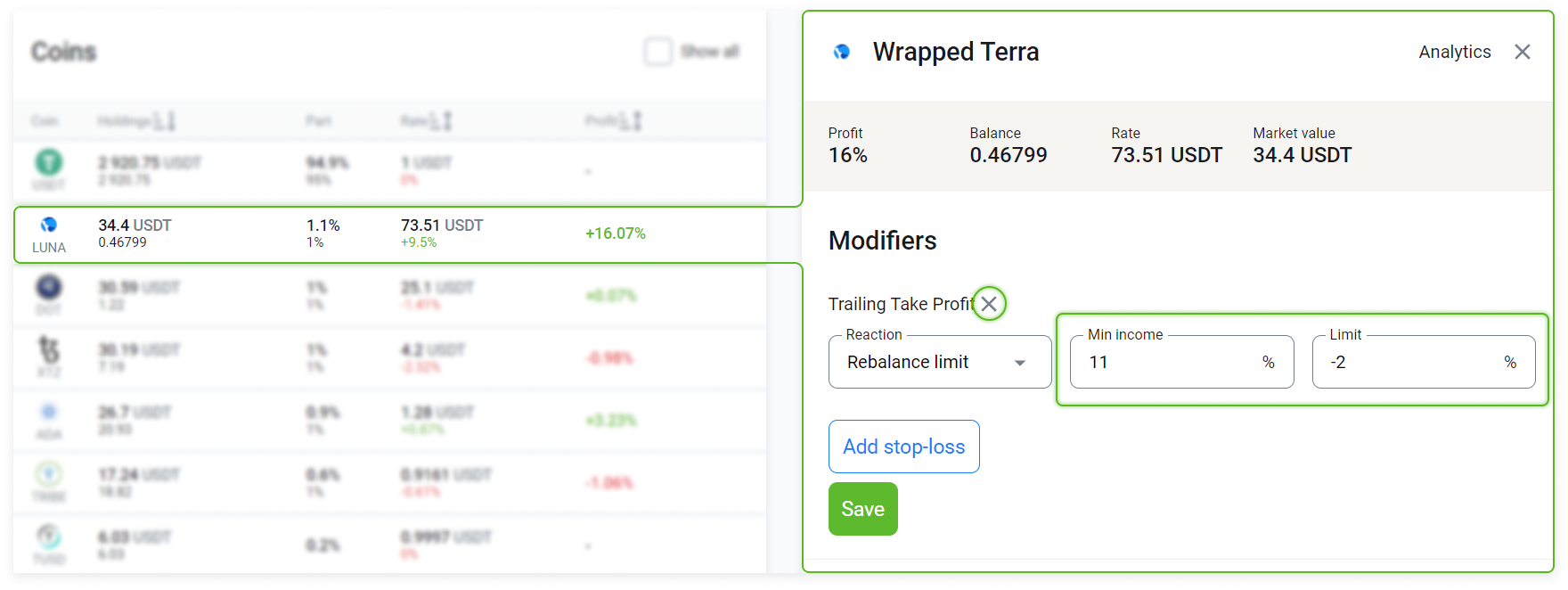

Configuration example in the Portfolio

When a strategy is being followed, it is convenient to add, change, or remove the Trailing Take Profit modifier by selecting the corresponding asset in the Coins table

You can decide about whether to apply the modifier to this asset by looking at the change in Profit.

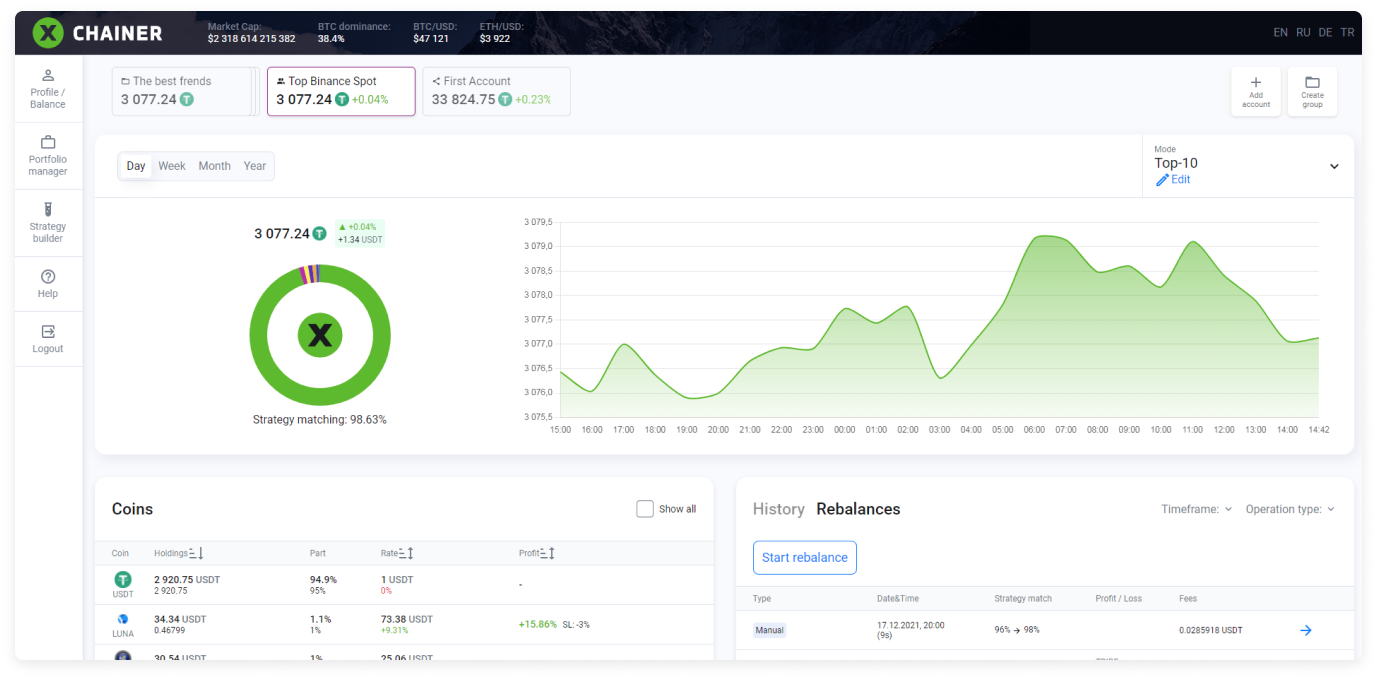

After you select an asset in the Coins table, on the right you will be able to add or edit modifiers and save them while applying them to all accounts where this strategy is being followed.

When working with modifiers from a portfolio, the system will remind you of which accounts are following this strategy, and any change to the modifier will affect all these accounts.

If you would only like to apply the changes to one account, then you can create a copy of the active strategy.

Select Add Trailing Take Profit.

Here you can further configure the modifier in the portfolio, and the interface looks the same as in the Strategy Editor.

The Trailing Take Profit modifier can be changed or removed at any time before it is executed.

To change or remove the modifier in the Strategy Editor, apply the changes to the Modifiers section.

To remove an unnecessary modifier, select the "X" icon.

Changes will be applied to all accounts where this strategy is being followed. Select Save.

Please note: It is not recommended to apply modifiers to most positions in your portfolio. The main purpose of this tool is to protect the investor while investing in new high-risk assets.

What should you do when the Trailing Take Profit modifier is triggered?

The investor can take one of three possible actions.

1. On the right side, above the History table, we see the system offer Restore.

Select Restore. A rebalancing will be performed whereby the asset sold at a Trailing Take Profit will be repurchased and the previously set Trailing Take Profit with the established coefficient of 11% for the modifier and a conversion trigger to the base currency of -2% will be maintained.

2. Change the portfolio structure by editing the strategy. After the changes to the strategy have been saved, rebalancing will be performed.

3. Do not take any action until the market situation changes.