After the Stop-Loss or Trailing Take Profit Modifier is triggered, the asset for which it was set is sold, and its share in the portfolio is occupied by the base currency USDT, USDC, BUSD or Bitcoin.

After the modifier is executed, the investor can take one of three possible actions. Consider the example of the Trailing Take Profit modifier:

Option one. Accept the Restore offer from the system. In this case, rebalancing will be performed. The asset will be acquired again, and the strategy portfolio will be restored to its original state.

Example.

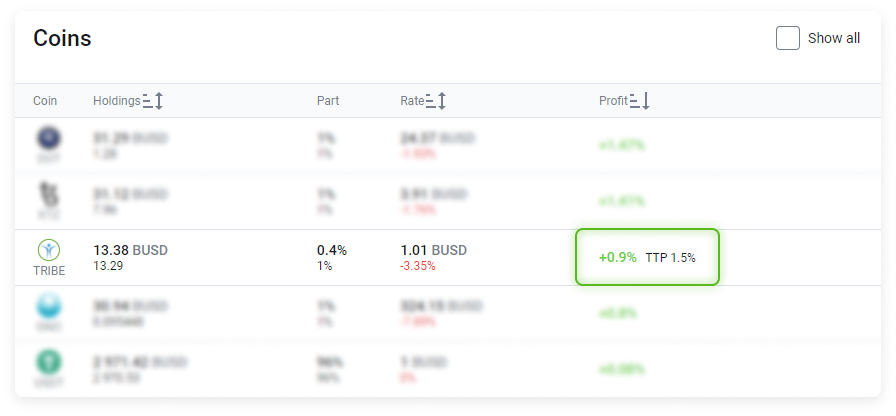

We had a TTP set on the TRIBE 1,5%.

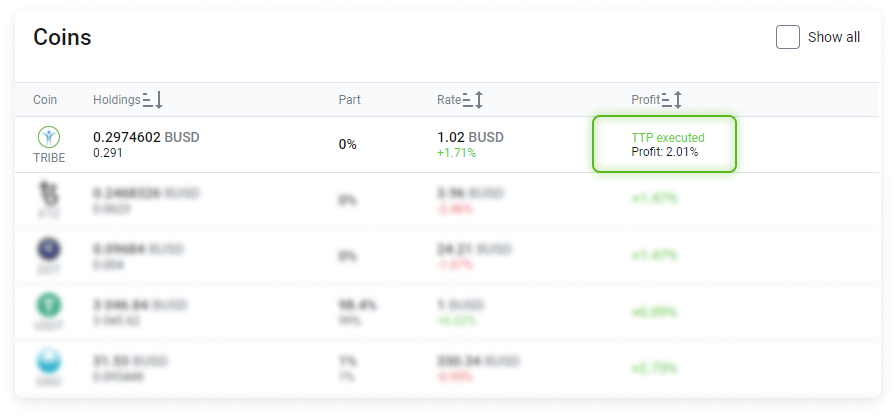

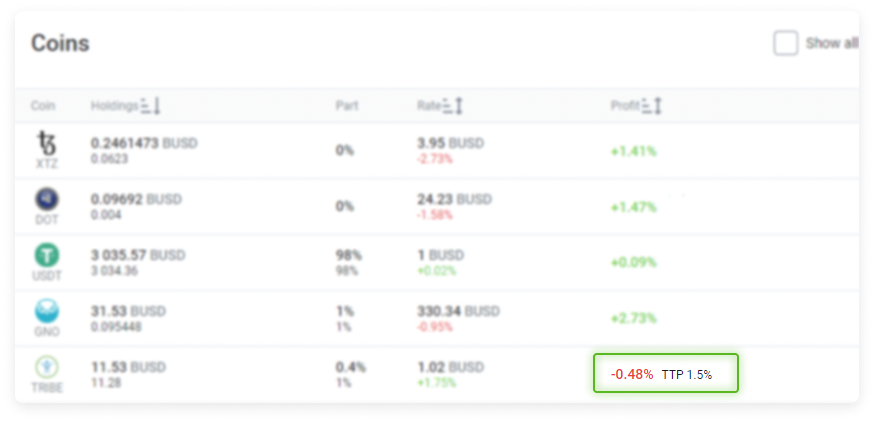

After the asset return has reached the value set in the modifier, it is sold for the base currency, and a corresponding entry is made to the Coins table.

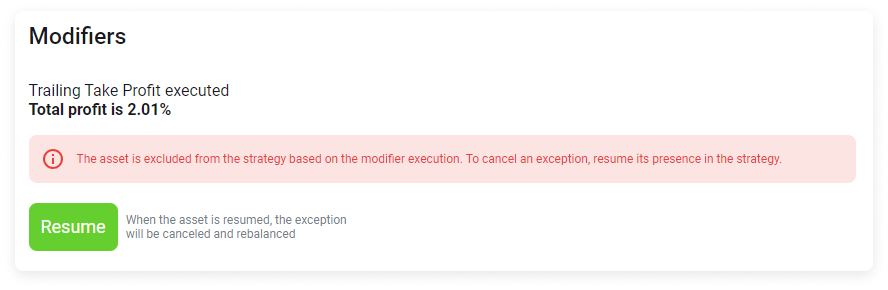

On the right side, above the History table, we see the system offer.

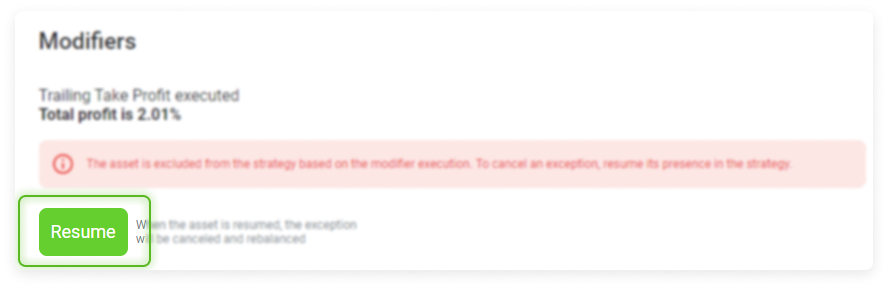

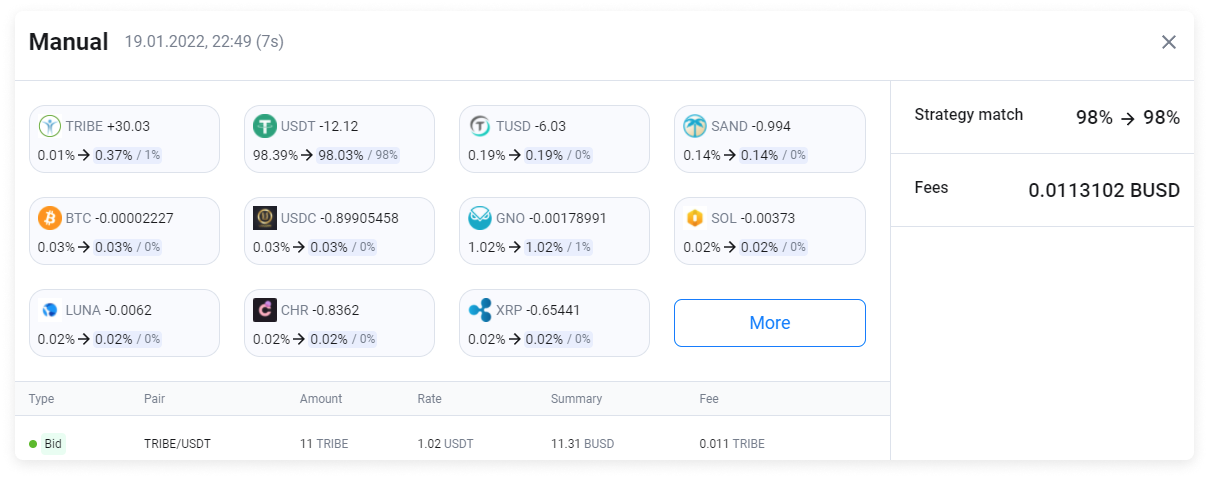

Select Restore. The following will be executed:

Purchase of an asset sold at a TTP and rebalancing;

The previously set Trailing Take Profit is saved with a coefficient in the modifier of 1.5%.

The asset has reappeared in the table with the previously set Trailing Take Profit.

Please note: The setting 1,5% will be calculated from the new entry point, namely the price at which the asset was re-purchased.

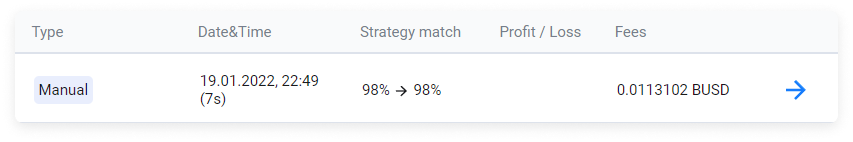

After the asset is restored in the portfolio, an entry will appear in the Rebalancing history table.

By selecting a row, you can see more detailed information about the change in the asset ratio.

After the asset is restored in the strategy portfolio, the share of USDT decreased by 0.36%. It went from 98.39% to 98,03%.

The share of TRIBE in the portfolio went from 0,01% to 0.37%.

Option two. Remove the sold asset from the strategy portfolio by editing it and rebalancing it.

Example.

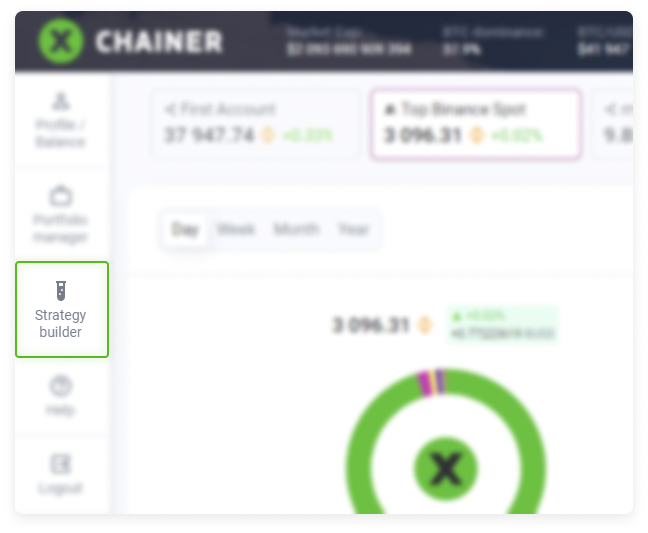

Log in to the Strategy Editor.

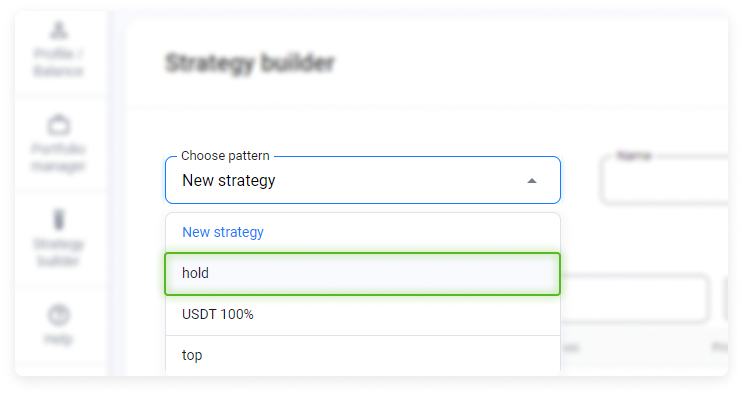

In the drop-down list, select the strategy from which we want to remove the asset.

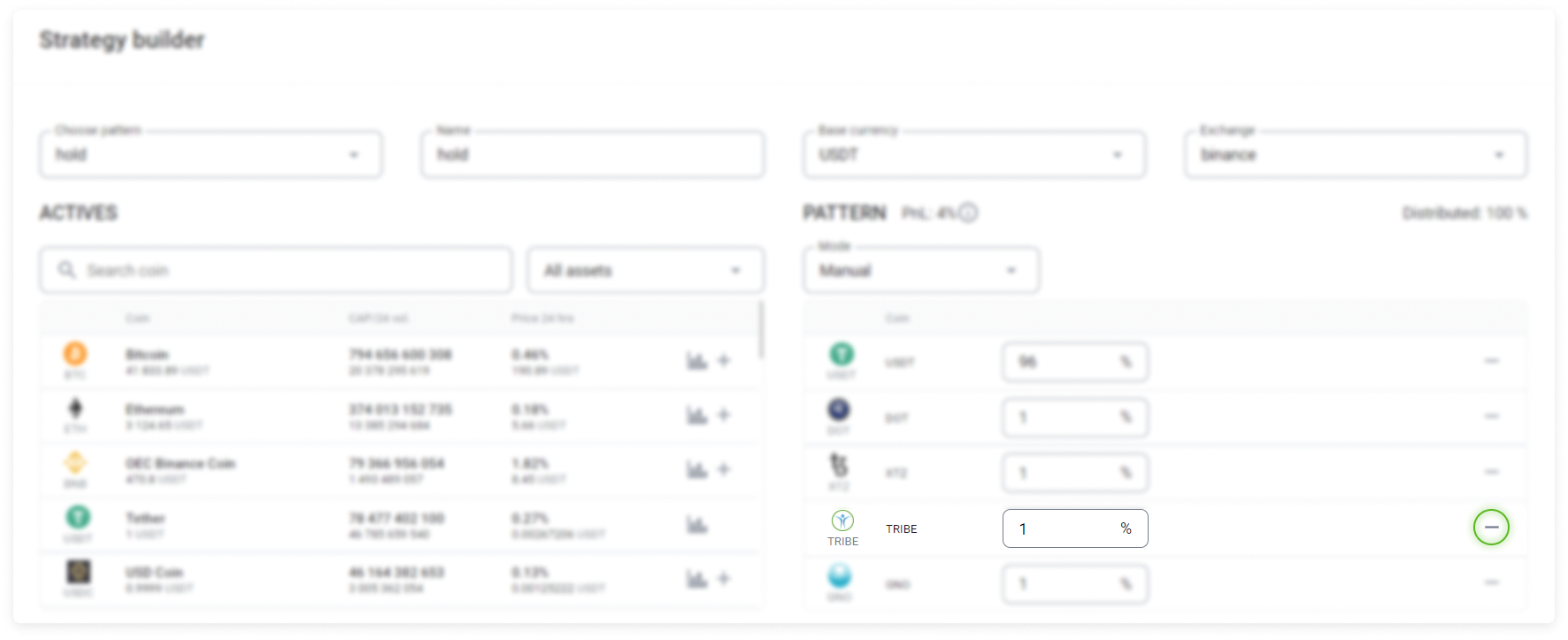

In the Structure section, delete the asset by selecting the Minus icon.

The structure will change, and the distribution of weights will not equal one hundred percent. In our example, it will be 99%..

You need to add one or more assets for this weight to the strategy structure (it is 1% in the example) or distribute this weight to other assets in the strategy.

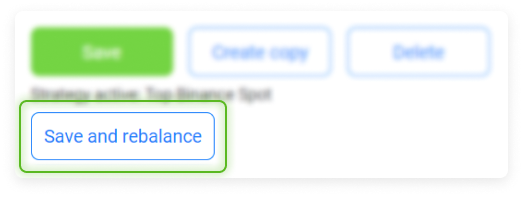

Select Save and rebalance.

The rebalancing will start.

And option three. Leave everything alone until the market situation stabilizes.