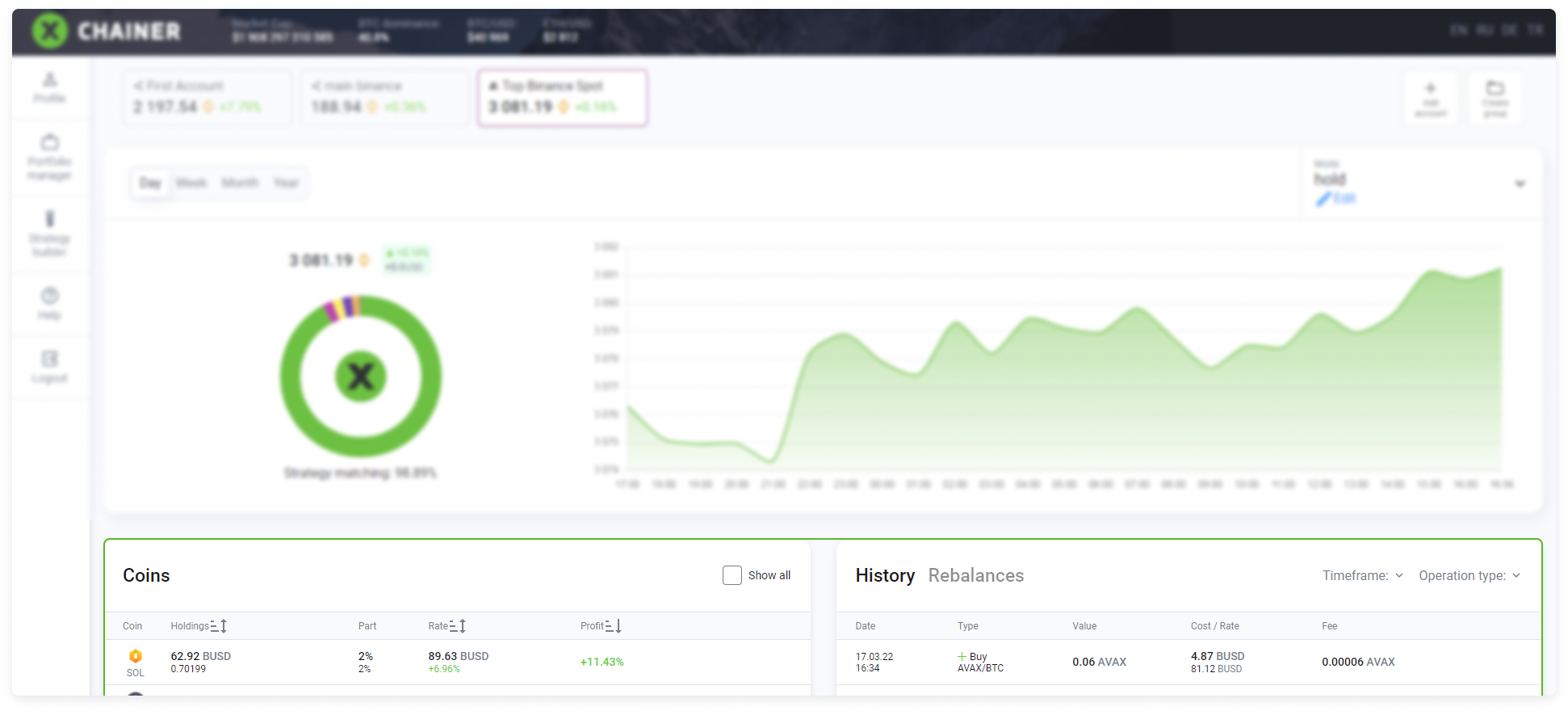

The income is calculated based on the asset quantity in the portfolio, the corresponding entries in the History table, and the current value (Coins table, Rate column).

Let's consider asset income based on the example of a working strategy.

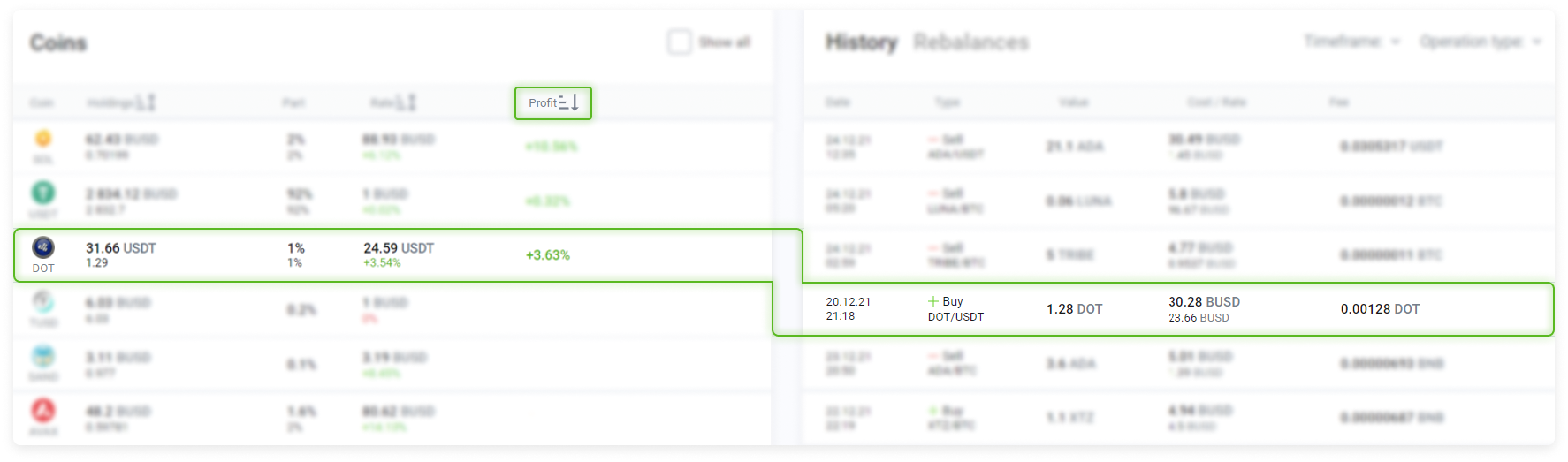

Example 1.

Select the asset DOT from the Coins table. Detailed information, including order history, will be displayed on the right side.

In the Holdings column of the Coins table, we can see that there are currently 1.29 DOT tokens in the portfolio.

The History table contains an entry for the purchase of 1.28 DOT tokens for USDT. The asset was purchased at a price of $23.72.

The current price in the Coins table is $24.59 (which is determined based on offers in the order book).

The income is calculated from the difference in the purchase price of an asset and the ability to sell it. In our case, this is +3.63%.

Please note: The DOT asset purchase transaction was able be executed for BTC. In this case, the yield calculation is converted to USDT (USDC, BUSD) in accordance with the profile's base currency settings. Similarly, assets purchased during the rebalancing process on the ALTS market for ETH, TRX, and XRP will be converted.

Please note: It is not the exchange rate that is used to calculate income, but rather the ability to sell an asset on the basis of orders in the order book at the current moment.

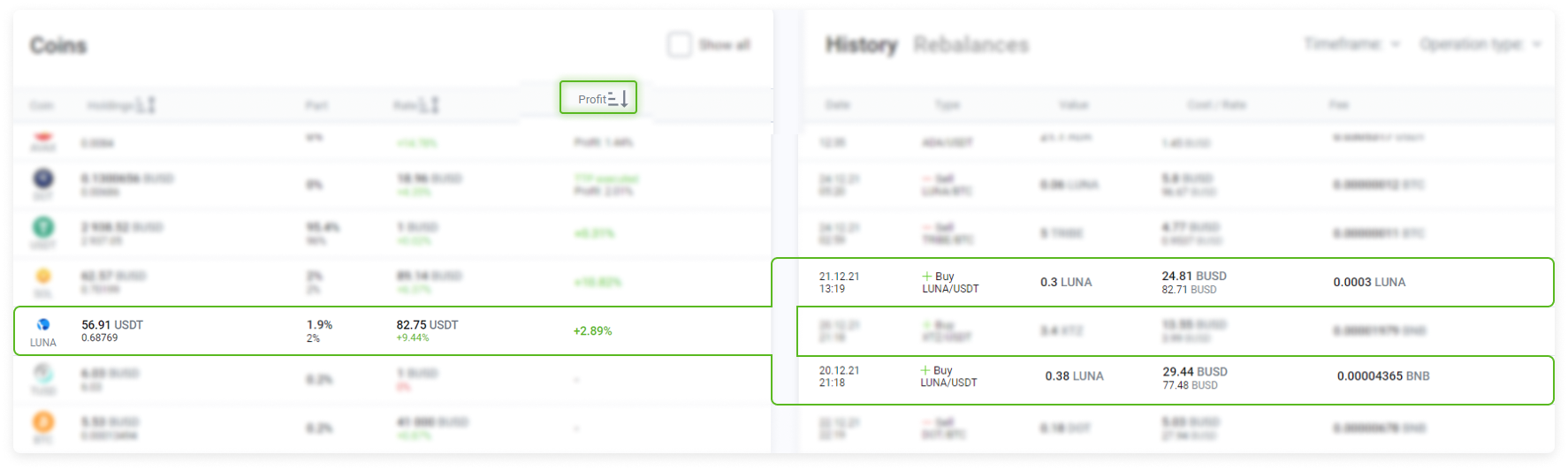

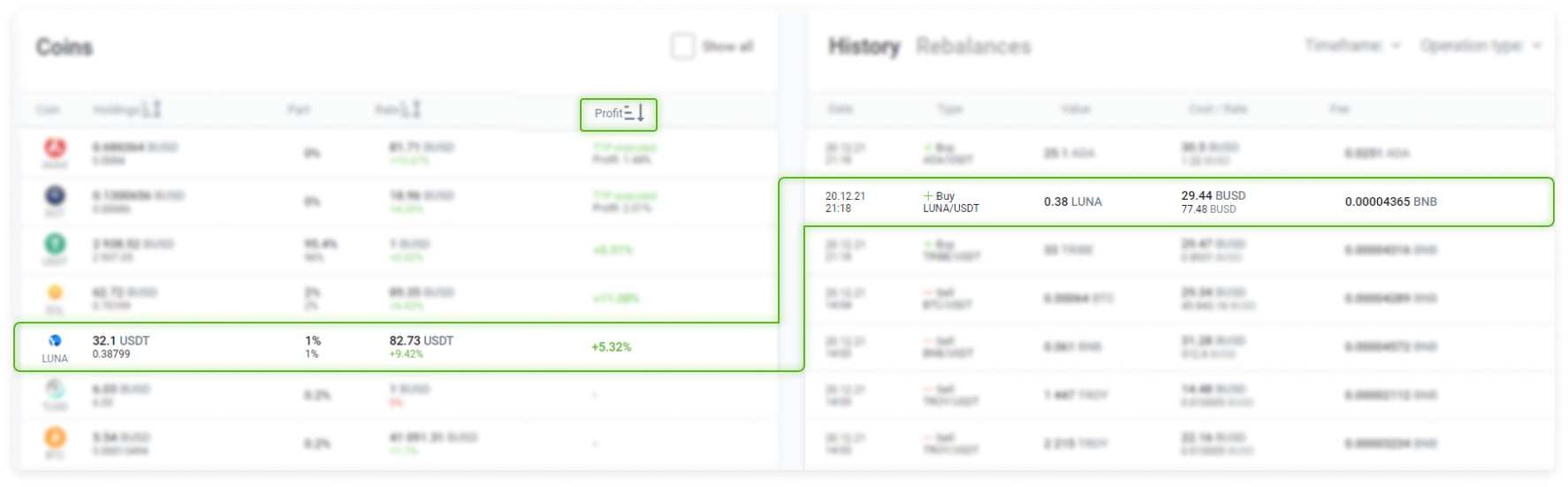

Example 2.

A more complex example: the current amount of an asset is determined based on two orders.

We bought 0.38 LUNA at a price of $78.87. The next day, its exchange rate rose to $82.73, thereby producing income of +5.32%.

We see that the market is growing and decide to increase the asset share in our portfolio by 1%.

We changed the strategy structure and chose “Save and rebalance”. XChainer performed a rebalancing, increasing the share of the LUNA asset by 0.3. The purchase was made at the exchange rate price of $82.84. The Income was recalculated, and now it is +2.89%.